Created in 2009, Bitcoin is a form of digital currency, or cryptocurrency, that has taken the world by storm. The origins of Bitcoin, however, are still somewhat shrouded in mystery. The astronomical uptick in the popularity of bitcoin, and by extension, cryptocurrency, is because this digital currency promises lower transaction fees than traditional payment channels such as banking and is operated by non-governmental authorities.

How Cryptocurrency Bitcoin Works

Bitcoin is one type of numerous cryptocurrencies that exist in the digital space. Unlike what one sees when they Google Bitcoin, there are no physical coins. In reality, cryptocurrencies work by keeping balances on a distributed ledger that is open to anyone and everyone.

The Blockchain

Cryptocurrency can offer transparency and security of transactions thanks to the characteristics of a protocol known as the blockchain. Understanding blockchain itself is simple enough. As the name suggests, the protocol consists of a chain of blocks that hold information. Once the information has been stored onto a block, altering the data becomes pretty much impossible without leaving behind proof of tampering.

How Does the Blockchain Work?

The data stored inside of the blockchain varies based on the type of blockchain- Bitcoin, for instance, stores details about a transaction such as a sender, the receiver, and the amount.

Each block in the chain contains three main components:

(a) the data,

(b) a hash of itself, and

(c) the hash of the previous block in the chain.

The hash is like a fingerprint that is always unique to each block. Every time data contained within a block is tampered with, the hash of said block changes. Because of this property, hashes help detect any changes. When a change is made to the second block in a blockchain, its hash will also change. Then, because the next block is linked to the second block using its hash from before any changes were made to the data causing the hash to change, the link will break, and all other blocks after the second block will be rendered useless.

To lend even further credibility to transactions, blockchains like Bitcoin have proof of work, which slows down the addition of new blocks. Finally, blockchain is distributed through an open ledger that practically anyone can join to eliminate any lingering risks of tampering. The whole network of participants on the ledger has to have a consensus on the validity of a new block. The peer-to-peer network will reject blocks that show signs of tampering.

Bitcoin Balance

As mentioned earlier, information stored on blocks in Bitcoin includes balances and buyer/seller data. The balance, in this case, is stored using long sequences of numbers and letters that are connected through an algorithm. These sequences are referred to as “keys,” which can be both private as well as public. A private key is used to authorize Bitcoin transmissions, and as such, must be kept secret and secure (think- ATM pins). On the other hand, public keys are essentially the address published to everyone so that bitcoins may be sent to the said address (think- a bank account number). These “keys,” however, are not interchangeable with Bitcoin wallets, contrary to popular belief. A Bitcoin wallet is a device, either physical or digital, that enables the trade of bitcoins and helps account for the ownership of the coins.

Bitcoin Mining

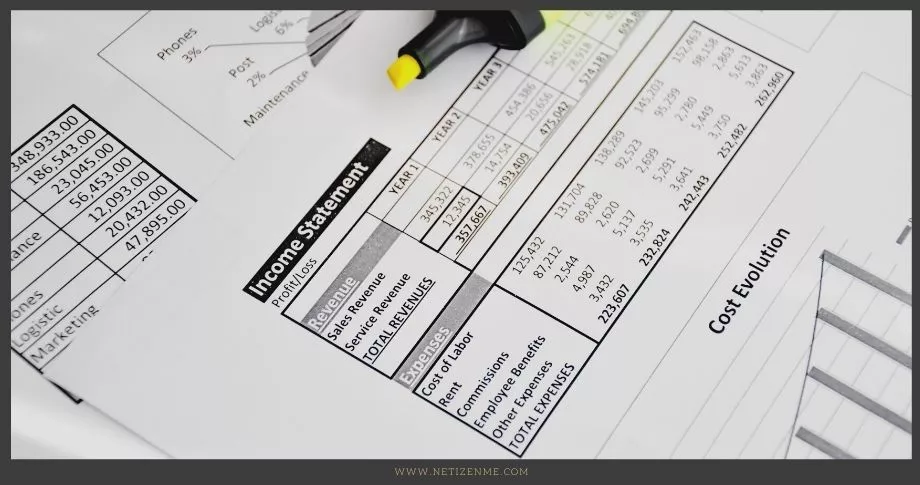

The process of bringing Bitcoin into circulation is known as Bitcoin mining. It entails discovering new blocks and adding them to the blockchain. This process is responsible for adding and verifying all transactions on the ledger.

Check the following reference articles to learn more about how cryptocurrency (bitcoin) works:

- Bitcoin Definition. (n.d.). Investopedia. Retrieved July 22, 2021, URL

This article is written by:

Jegatheesh Waran

Jegatheesh Waran is a trade investor and content creator specializing in the dynamic world of cryptocurrency. With a wealth of experience in the financial markets, Jegatheesh brings a unique perspective to his writing, offering insights and analyses that cater to both novice and seasoned investors.