Stocks as an Investing Option

Stocks, also referred to as shares or equities, are investment options that allow you to own a portion of a public-traded corporation. When you buy stock, you’re buying an ownership stake in a publicly traded company. You can hold the stock and earn dividends or sell them for a profit when the prices go up.

Which stock is best for option trading?

When looking for the highest-performing stock, investors must consider long-term performance and not short-term volatility (3). Examples of high performing stocks include:

| Symbol | Company Name | Description |

| TSLA | Tesla, Inc. | Tesla designs, manufactures, and sells high-performance fully electric vehicles and energy storage products. |

| BA | The Boeing Company | Boeing is a leading maker of large commercial jets and a top defence contractor. |

| FB | Facebook, Inc. | Millions of people use Facebooks social networking website every day to keep up with friends, upload photos, and share links. |

| BIDU | Baidu, Inc. | Baidu is the leading Chinese-language Internet search provider. It is categorized in the communication services sector and the interactive media and services industry. |

Potential risks of stock investment

Risks associated with investing in stocks include:

- Market value risk: The value of stocks may decline because of economic developments or other market events, resulting in investor losses. “By diversifying investments across several sectors, investors have a better chance of participating in the growth of some of their stocks at any one time” (2).

- Inflationary risk: Also known as purchasing power risk, refers to the risk of loss based on the chance that the cash flowing from an investment today might not be worth as much in the future. Although stocks are considered to be “the best protection against inflation since companies can adjust prices to the rate of inflation, a global recession may mean stocks will struggle for a while before the economy is strong enough to bear higher prices” (2).

- Concentration risk: This is the risk of loss associated with focusing on one investment option.

- Liquidity risk: When investors can’t sell off stocks or other investments quickly to prevent or minimize loss, liquidity risk arises.

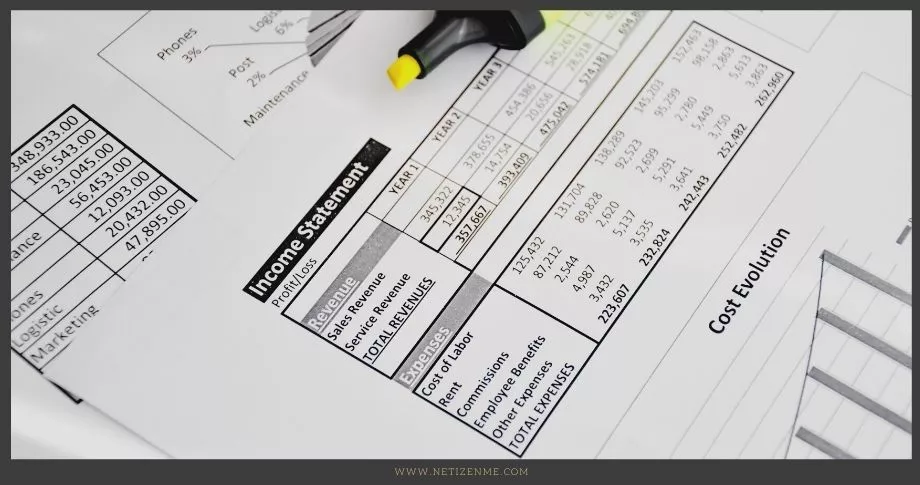

Stocks vs other investment types

- Banks accounts: Bank accounts offer you funds the opportunity to earn interest and grow slowly with a lower risk of losing your money. Stocks give your money the potential for high growth.

- Bonds: While stocks give you part-ownership, bonds are loans from you to an entity such as a company or the government. Bonds pay fixed interest over time and are less volatile compared to stocks. When held to maturity, they offer consistent returns.

- Mutual funds: A mutual fund is a pool of many investors’ money invested in various securities, including stocks, bonds and other investment assets. It offers investors a way to diversify their portfolios, unlike stocks where they put their money into a single company. However, “individual stocks are more tax-efficient compared to mutual funds and are best utilized in taxable portfolios” (1).

Selecting individual stocks can be difficult, the reason why “many investors turn to index mutual funds and ETFs, which bundles stocks together. When individual stocks come together into a diversified portfolio via index funds, they have more power (3).”

Check the following reference articles to learn more about stocks as an investing option:

- Carosa, C. (2020, December 16). 5 Reasons You Should Own Stocks Instead Of Mutual Funds (Or ETFs). Forbes. URL

- Little, K. (n.d.). A Look at the Major Types of Risk for Stock Investors. The Balance. URL

- O’Shea, A. (2018, October 26). Best-Performing Stocks: March 2021. NerdWallet. URL

- What is the Colombo Stock Exchange (CSE)?

- How Do Dimensional Fund Advisors Profit from the Efficient Market Hypothesis?

- Approaches to Designing a Budget

This article is written by:

Our professional writers and editors are passionate about sharing high-quality information and insights with our audience. We conduct diligent research, maintain fact-checking protocols, and prioritize accuracy and integrity to the best of our capacity.

You can cite our articles under the author name "Netizenme"