Inventory valuation is a crucial aspect of inventory management because it allows you to evaluate the cost of goods sold (COGS) and profitability. This process also helps businesses to ensure they hold the right amount of inventory. Also, it has significant tax implications.

What is the Optimal Inventory Valuation Method for Your Business?

Selecting the right inventory valuation method is a critical decision for businesses. It directly impacts financial statements, tax liabilities, and profitability. It helps businesses to determine the optimal inventory valuation method that best aligns with their specific needs and objectives. It involves carefully considering various methods, such as FIFO, LIFO, and weighted average, and how they can influence financial reporting and decision-making.

What is Inventory Valuation?

Inventory valuation is an accounting practice used to determine the value of unsold inventory stock. It calculates the value of the company’s inventory at the end of an accounting period. It is important because the excess or shortage of inventory affects production and profitability.

What are the four methods of inventory valuation?

There are four accepted methods of inventory valuation:

01. The Specific Identification Method

This method involves tracking every piece of inventory by assigning it a specific cost and adjusting the balances when you sell it. You must track every item individually with an RFID tag, stamped receipt date, or serial number. Indeed, it is best suited for a business that sells very different products that vary in value.

The main advantage of the unique identification method is accuracy. The drawback is that it is only feasible for small businesses or startups.

02. LIFO (Last In, (Last Out)

LIFO assumes that the most recently purchased or manufactured items are sold first. When prices of goods increase, COGS in the LIFO method is relatively higher, and the ending inventory balance is somewhat lower (04)

LIFO is best suited in situations where there are drastic market changes or when there is endless demand and established production. LIFO’s main advantage is that it allows you to match your most recent costs against your revenue, increase inventory valuation, and lower net income. It is important to note that IFRS does not permit this method, and you must seek IRS permission to use it.

03. WAC (Weighted Average Cost)

WAC bases inventory and COGS on the average cost of all items purchased during a period. It calculates inventory value by dividing the cost of goods available for sale by the units available for sale.

Weighted-average cost per unit = cost of goods available for sale / Total units in inventory

The main advantage of WAC is that it can be used in “businesses that have a high volume of inventory with items that are the same or familiar” (01).

The inventory valuation method best suited for OPQ Distribution

04. FIFO (First In, First Out)

The FIFO method assumes that inventory items are sold in the order they were manufactured or purchased. The oldest inventory items are sold first. This method is best suited for businesses that deal with perishable goods or items that can become outdated, such as clothing.

This method is popular because of its intuitiveness, accuracy, and simplicity. Calculate FIFO by multiplying your oldest inventory’s cost by the amount of that inventory sold.

OPQ is a medical supply distributor. Therefore, FIFO is best suited as a valuation method to reduce expensing the inventory as it assumes the cost of older items that are distributed first.

The IRS stipulates that, for tax purposes, FIFO is the only inventory costing method you can use if your business has international locations.

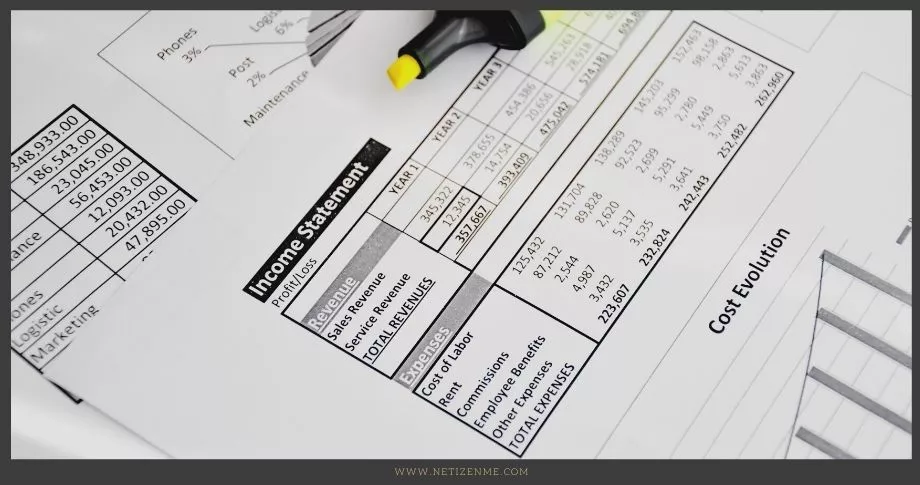

The cost of goods sold, ending inventory, and how does the FIFO inventory valuation method impact these two factors?

Under FIFO, the cost of the goods sold is based upon the cost of materials bought first within the period, and the cost of ending inventory is based upon the cost of materials purchased later. Hence, inventory is valued close to the current replacement cost. During periods of inflation, FIFO results in lower COGS and the highest net income.

Choosing the right method is crucial “as it has a direct impact on the business’s profit margin. Indeed, your choice can lead to drastic differences in the cost of goods sold, net income and ending inventory” (02). Some of the things to consider before choosing an inventory method include:

- Whether prices stay stable over time

- “Whether your costs are going up or down” (01)

- How much your inventory varies

- “Are you willing to keep this type of valuation for the fiscal year?” (01)

Check the following resources to read more:

- Callarman, S., & Callarman, S. (2020, July 31). 4 Inventory Valuation Methods Used by Ecommerce Businesses. ShipBob. (Link)

- What Is Inventory Valuation and Why Is It Important. (2020, July 20). FreshBooks. (Link)

- Davies, R. (2020, November 24). 4 Inventory Costing Methods for Small Businesses. The Blueprint. (Link)

- Comparing different inventory valuation methods: FIFO, LIFO and WAC. (n.d.). Tradegecko.Com. (Link)

- How American Express leverages diversity

- Techniques to Shift from Individual to Corporate Foresight

- The Digital Workspace

This article is written by:

Our professional writers and editors are passionate about sharing high-quality information and insights with our audience. We conduct diligent research, maintain fact-checking protocols, and prioritize accuracy and integrity to the best of our capacity.

You can cite our articles under the author name "Netizenme"