Transitioning from Cash Basis to Accrual Basis

The accounting method is one of the first decisions a business owner needs to make. The most commonly used methods are cash and accrual basis. The main difference between the two is income and revenue recognition timing.

The cash basis of accounting recognizes and records revenue and expenses only when cash is received or paid out. On the other hand, the accrual basis of accounting recognizes and records revenue when earned and expenses when bills get paid.

Cash or accrual basis, which one will work best? When is the best time to transition from a cash basis to an accrual basis? What are the pros and cons of transitioning from cash to accrual basis accounting?

Cash basis vs. accrual basis accounting methods

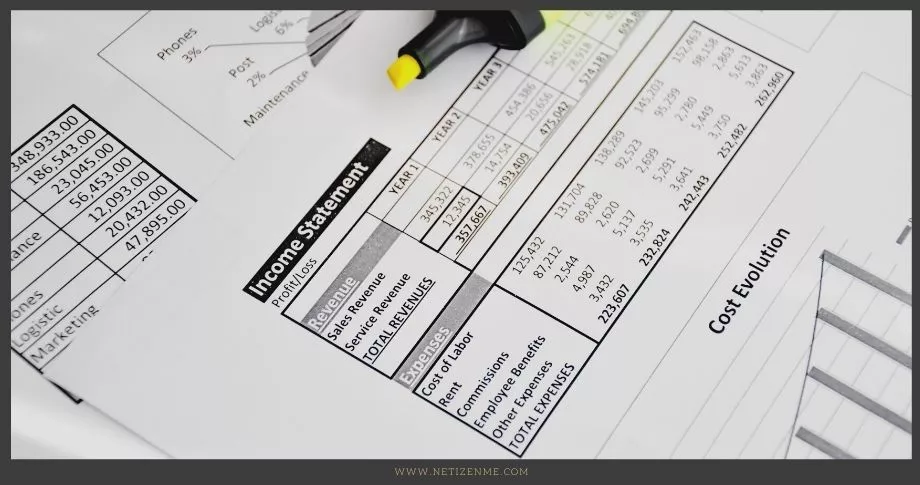

| Cash basis | Accrual Basis | |

|---|---|---|

Appropriate use | Small business and sole proprietorship with no inventory | Required for businesses with revenue over $25 million |

Pros |

|

|

Cons |

|

|

When to transition from a cash basis to accrual basis accounting?

Most start-ups use cash until they face situations that would make accrual accounting more appropriate. Some of the factors that would warrant a transition include:

- Tax regulations: Most businesses have to switch once a company grows to a certain scale to comply with the tax regulations.

- Audit purposes: Audited financial statements are needed when preparing for a sale, going public, or obtaining a loan.

- Securities and Exchange Commission (SEC): Accrual accounting is required to meet the generally accepted accounting principles (GAAP), a requirement by the SEC.

- Securing government contracts: You need accurate financial records to bid and win government contracts. It means being compliant with GAAP standards and using the best accounting practices.

Pros and Cons of transitioning from cash basis to accrual basis

Pros

- Clear financial position: Periodic financial statements will become more representative of your business’ health.

- Business analysis: Matching revenue and expenses using the accrual basis allows you to conduct a more helpful business analysis.

- Enhances financial management and planning: It allows you to create realistic budgets and financial projections for planning purposes.

- Compliance with GAAP: It is the preferred method and is deemed to be more accurate

Cons

- You have to pay taxes on money yet to be received.

- Time-consuming and increased costs: this method requires more time and expertise. You might need to hire an expert.

If your business is already using cash, it is time to transition to an accrual basis if you plan to expand your business. Accrual accounting isn’t the easiest, but it has many advantages for businesses on a growth path.

Read More:

- Congressional Research Service. Cash Versus Accrual Basis of Accounting: An Introduction, Pages 3-4. (URL)

- Publication 538 (01/2019), Accounting Periods and Methods: Internal Revenue Service. (URL)

- What is the Colombo Stock Exchange (CSE)?

- How Do Dimensional Fund Advisors Profit from the Efficient Market Hypothesis?

- Approaches to Designing a Budget

This article is written by:

Our professional writers and editors are passionate about sharing high-quality information and insights with our audience. We conduct diligent research, maintain fact-checking protocols, and prioritize accuracy and integrity to the best of our capacity.

You can cite our articles under the author name "Netizenme"