Improve Your Credit and Achieve Your Financial Goals

Your credit score is a crucial factor that can impact your financial well-being in numerous ways. A higher credit score can help you secure lower interest rates on loans and credit cards, increase your chances of getting approved for a mortgage or rental application, and even impact your employment opportunities. If you’re looking to improve your credit score, there are several strategies you can use to achieve your financial goals. This article will explore the top strategies for boosting your credit score and maintaining good credit.

Check Your Credit Report Regularly

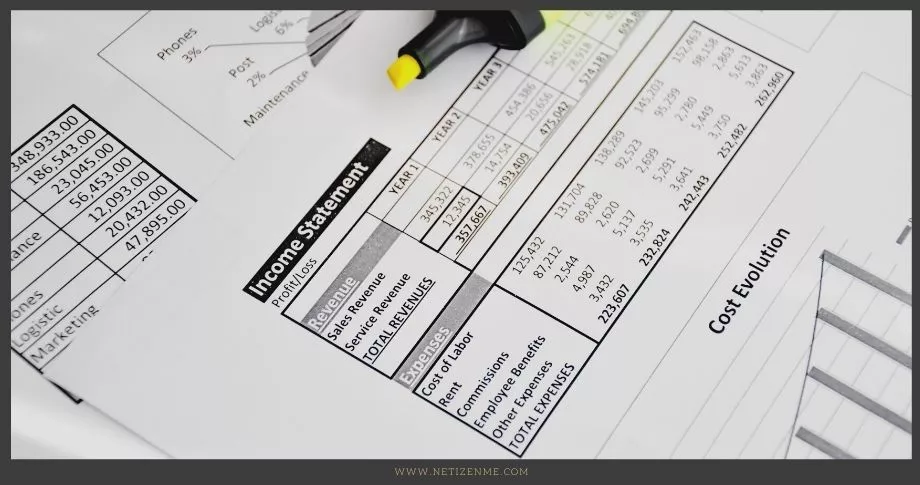

The first step in improving your credit score is regularly reviewing your credit report. You can obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once yearly. Checking your credit report regularly can help you identify any errors or inaccuracies that may negatively impact your credit score. If you find any errors, you can dispute them with the credit bureau to correct them.

Pay Your Bills on Time

One of the most important factors that impact your credit score is your payment history. Late or missed payments can significantly lower your credit score, so paying your bills on time is crucial. Set up automatic payments or reminders to help ensure you don’t miss any payments. If you’re struggling to make payments, contact your creditors to discuss payment options or consider working with a credit counselor.

Keep Your Credit Utilization Low

Your credit utilization ratio is another important factor that impacts your credit score. This ratio compares your credit card balances to your credit limits. Low credit utilization (ideally below 30%) can help improve your credit score. If you’re struggling to keep your credit utilization low, consider increasing your credit limit or spreading out your purchases over multiple cards.

Limit New Credit Applications

Applying for new credit, such as a credit card or loan, can result in a hard inquiry on your credit report. Too many hard inquiries can lower your credit score, so limiting new credit applications is important. Only apply for credit when needed, and research credit offers before applying to ensure you’re applying for the best options for your financial situation.

Consider a Secured Credit Card

If you’re struggling to get approved for a traditional credit card, consider a secured one. These cards require a security deposit, which serves as collateral for the credit card. Using a secured credit card responsibly can help build your credit history and improve your credit score.

Boosting Your Credit Score

Improving your credit score may take time and effort, but it’s worth it for the financial benefits of good credit. By reviewing your credit report regularly, paying your bills on time, keeping your credit utilization low, limiting new credit applications, and considering a secured credit card, you can take the necessary steps to boost your credit score and achieve your financial goals. Remember to be patient and persistent in your efforts to improve your credit, and seek professional guidance if you need additional support along the way.

- Finance a Small Business

- How to Develop a Financial Plan in 7 Simple Steps

- Which Inventory Valuation Method is The Best for Your Business?

This article is written by:

Our professional writers and editors are passionate about sharing high-quality information and insights with our audience. We conduct diligent research, maintain fact-checking protocols, and prioritize accuracy and integrity to the best of our capacity.

You can cite our articles under the author name "Netizenme"