An income statement is one of three companies’ core financial statements. The others are the balance sheet and cash flow statement. This statement mainly aims to show the company’s profit and loss over a period. In addition, the income statement sums up a company’s total expenses and revenues for a specific period.

Financial Statements

Since it shows a firm’s profitability for a period, it is also called a profit and loss statement. It focuses on the income and expenses incurred during a specific period, such as quarterly or annually.

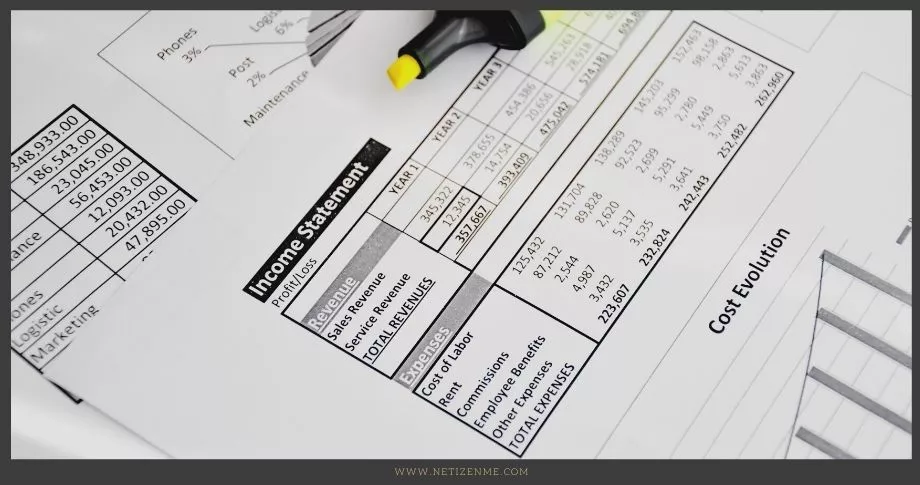

Simple Income Statement

There are two types of income statements, i.e., single-step and multi-step.

What is the purpose of an income statement for a retail business? Which statement format do you choose? What are the benefits and challenges of your statement choice for each stakeholder group? Let’s discuss it!

What is a simple income statement?

The simple income statement is also referred to as the single-step income statement. This is because it uses a single equation to calculate the firm’s net income.

Net Income = (Revenues + Gains) – (Expenses + Losses)

An example of a simple income statement is as below:

Format and preparation of simple income statements

Revenue and gains are the total money an entity receives from selling services and goods in a given period, together with the capital gains. Sometimes it is referred to as the top line because it appears as the first item on top of the statement.

Expenses and losses include all the money an entity spends to maintain and carry out operations. All expenses are listed under a single standard heading. The simple income statement does not differentiate between non-operating and operating expenses, including rent, materials, marketing, and depreciation (1).

Pre-tax profit is arrived at by subtracting the expenses from the revenue. Net income is determined by subtracting the total expenses, including taxes, from the total revenue.

Pros and cons of a simple income statement

Pros

- It is easier to prepare, use, and understand

- The company does not need an expert to manage the company records.

Cons

- It lacks sufficient information for investors to assess the company’s health other than using its net income.

- It does not give any gross or operating margin data, making it challenging to identify expense sources.

- It isn’t easy to make accurate future financial projections.

Analysis of the income statement may reveal if sales are improving and if the return on equity is expanding. These statements are helpful for investors and lenders because they show the firm’s performance and how effective the management is.

References used in this simple income statement article:

- Franklin, M., Cooper, D., & Graybeal, P. (2019). Principles of Accounting, V1. OpenStax. (URL)

- P, A., & E, M. (2010). Management and Cost Accounting. Financial Times Prentice Hall Harlow. (URL)

This article is written by:

Our professional writers and editors are passionate about sharing high-quality information and insights with our audience. We conduct diligent research, maintain fact-checking protocols, and prioritize accuracy and integrity to the best of our capacity.

You can cite our articles under the author name "Netizenme"