Practise of Issuing Promissory Notes

Promissory notes are written agreements regarding borrowed money. It is a promise to pay, and it contains the terms of the agreement in ensuring this happens. Financial institutions, small companies, and individuals can issue a promissory note. Let’s deep dive into the practice of issuing promissory notes.

“It is a common practice for government entities, particularly schools, to issue short-term (promissory) notes to cover daily expenditures until revenues are received from tax collection, lottery funds, and other sources. school boards approve the note issuances, with repayments of principal and interest typically met within a few months. the goal is to fully cover all expenses until revenues are distributed from the state. however, revenues distributed fluctuate due to changes in collection expectations, and schools may not be able to cover their expenditures in the current period. this leads to a dilemma—whether or not to issue more short-term notes to cover the deficit. short-term debt may be preferred over long-term debt when the entity does not want to devote resources to pay interest over an extended period of time. in many cases, the interest rate is lower than long-term debt, because the loan is considered less risky with the shorter payback period. this shorter payback period is also beneficial with amortization expenses; short-term debt typically does not amortize, unlike long-term debt”.

biz.libretexts.org

What is a promissory note?

“A promissory note refers to a financial instrument that includes a written promise from the issuer to pay” the payee a specific sum of money, either on-demand or on a specific future date (Corporate Finance Institute, 2019).

Promissory notes constitute three parties:

- Drawer/Issuer/Maker: The drawer is the person who agrees to pay the drawee a certain amount of money on the maturity of the note

- Drawee: This is the person in whose favour the note is prepared

- Payee: This is the person to whom payment is made.

In most cases, the payee and drawee are the same people to whom cash is paid.

Features of a promissory note:

- It should be in writing or print.

- The amount to be paid is defines

- It is duly signed and stamped by the issuer.

- It contains the promise to pay back the money must not depend on any condition or situation.

- Should have a legal composition

- Detailed information including the name of the drawer and payee, name and signature of the drawer, principal amount, rate of interest, etc

A common practice for government entities, particularly schools, is to issue short-term (promissory) notes to cover daily expenditures until revenues are received from tax collection, lottery funds, and other sources. School boards approve the note issuances, with repayments of principal and interest typically met within a few months. The goal is to fully cover all expenses until revenues are distributed from the state.

However, revenues distributed fluctuate due to changes in collection expectations, and schools may not be able to cover their expenditures in the current period (UoPeople, n.d). The school may not have cash in hand or finance at present but that doesn’t mean we need a long term financing solution as revenue will be distributed in a foreseeable future. Therefore, to cover the expenses temporarily, we will create a short term note payable via a loan which will be paid within the school accounting year.

Would you issue more debt?

To cover the expenses temporarily until the revenue will be distributed, more debt will be issued with an agreement for short term payable with an interest. These notes are negotiable legal instruments and the payee’s most assurance.

Are there alternatives to promissory notes?

- Bill of Exchange

This is a legally binding agreement by one party to pay a fixed amount of money to another party on demand or within a predefined time frame. It is used in transactions about goods and services and is primarily used in international trade.

- Personal Checks

A check contains an unconditional order requiring the banker to pay a fixed amount of money on demand to the bearer of the check or a specific person as per given instructions. It serves as a draft, payable by the issuer’s financial institution upon receipt in the exact (How Negotiable Instruments Work, n.d.).

Positives and Negatives to the Promissory Note Practice

Positives include:

- Doesn’t involve a lot of formalities allowing you to access finances faster. It is simple and straightforward.

- Flexible, allowing you to set the loan’s specific terms, such as when payments will be made, and the instalments, among other terms.

- Highly negotiable, making it a liquid investment. But, this will depend on whether the drawer is of a high credit standing.

- It is unconditional; hence the issuer can use the funds obtained without preconditions or restrictions.

- It doesn’t affect the business’ gearing level.

Negatives include:

- It is a short-term source of finance.

- There are possibilities that the issuer may fail to honour the note, resulting in losses for the payee.

Promissory notes are written agreements regarding borrowed money. A promissory note is a promise to pay, and it contains the terms of the agreement in ensuring this happens. It doesn’t involve a lot of formalities allowing you to access finances faster. It is highly negotiable, making it a liquid investment. But, this will depend on whether the drawer is of a high credit standing. It is a short-term source of finance for financial institutions, small companies, and individuals.

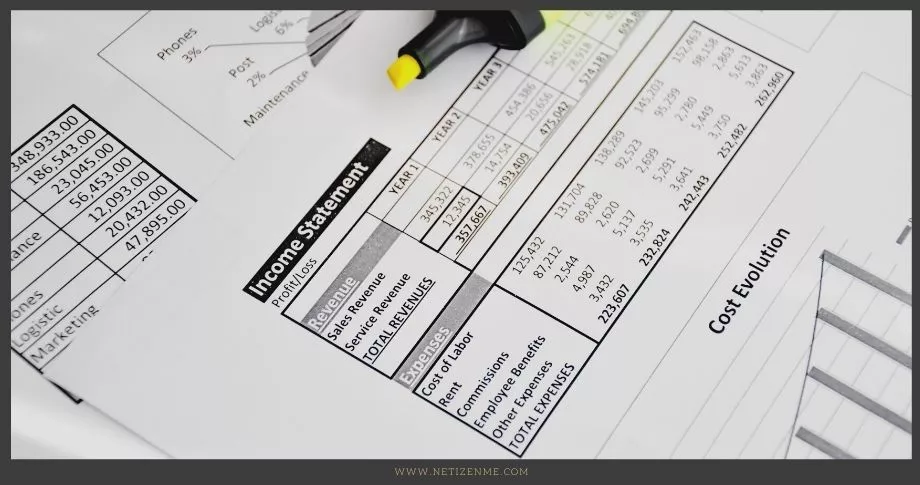

Bookkeeping:

The money borrowed is recorded by debiting Cash A/c and crediting the Notes payable A/c. When the note is repaid, credit the Cash A/c, debit the Notes payable A/c, and the interest A/c with the difference.

Read more about the practice of issuing promissory notes:

- Corporate Finance Institute. (2019, October 7). Promissory Note. (URL)

- How Negotiable Instruments Work. (n.d.). Investopedia. (URL)

- What is the Colombo Stock Exchange (CSE)?

- How Do Dimensional Fund Advisors Profit from the Efficient Market Hypothesis?

- Approaches to Designing a Budget

This article is written by:

Our professional writers and editors are passionate about sharing high-quality information and insights with our audience. We conduct diligent research, maintain fact-checking protocols, and prioritize accuracy and integrity to the best of our capacity.

You can cite our articles under the author name "Netizenme"