What are the 7 steps in the financial planning process?

Do you ever feel like no matter how hard you work or how much you earn, your finances always seem to get the better of you? What simple steps do you take to create a financial plan?

Financial freedom, which means being able to afford the kind of life we want and desire for ourselves and our families without being employed or dependent on other people, is a dream most of us have. This dream can, however, only be possible if we have better control of our finances.

In a world characterized by instant gratification and unlimited access to credit, people develop money problems because of their inability to manage finances and not low income. A personal financial plan is a roadmap for ensuring that you have better control over your money to achieve your financial goals and objectives.

What are the 7 steps of financial planning?

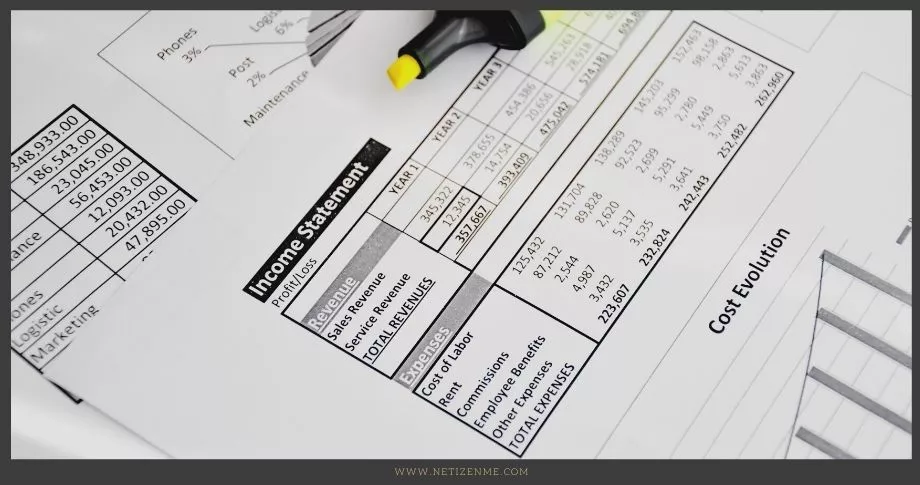

Step 1: Determine your current financial situation

The first step in developing a personal financial plan is to take a critical look into your current financial state to determine your net worth (the difference between your assets and liabilities).

On one side of two columns, make a list of your assets – anything you own that can be converted into cash, including investments, retirement savings, or money held in savings accounts. On the other side, list all your liabilities – debt, including all loans, outstanding bills, or credit card debts. Subtract your liabilities from your assets to determine your financial net worth.

Your financial net worth will give you a meaningful look into your current financial state with a positive one showing that you are doing well. In contrast, a negative one indicates the need to do a better job of managing your finances. Knowing your current financial situation will guide you toward making sound financial decisions when planning for the future.

Step 2: Set your financial goals

The overall goal of personal financial planning is to allocate resources optimally to achieve your financial goals. The second step, therefore, is to set your financial goals and objectives.

Where do you want to be, financially, in the next 5 – 10 years? Use answers to this question to set your goals for the short (car insurance, buying a phone or building an emergency fund), medium (getting a car or saving for a vacation), and long term (putting a down payment for a house or saving for retirement).

Be specific when setting goals in terms of numbers and timelines. Save $1000 in 1 year to take a trip to Bali is an example of how specific your goals need to be. Being specific makes it easier to measure progress and calculate the amount you need to save towards achieving a goal, weekly or monthly.

Tip: Always create an action plan, clearly stating all the possible sources of funds to achieve a particular goal (paycheck or other alternative sources), and the savings tool (bank or mutual funds account).

Step 3: Track your money

Tracking your money in the form of what’s coming in (income) and going out (expenses) is the third step. Use readily available free mobile apps or write them down in a notebook. Tracking your money highlights your spending habits, enables you to create realistic budgets, and shows you areas to cut expenses to increase overall savings.

Step 4: Start an emergency fund

Since tomorrow is unpredictable, planning for unexpected expenses (fixing leaking pipes, broken windows, or other small repairs around the house) is the next step. Setting aside some money to cater to unexpected expenses or emergencies ensures that you do not resort to debt or use funds meant for a different purpose. An emergency fund ensures that you stick to your personal financial plan.

Tip: The ideal emergency fund should be able to cover up to 3 – 6 months’ worth of your living expenses. Start small and work towards growing your emergency fund as you go along.

Step 5: Pay off debt

Another crucial step in developing a personal financial plan is determining how to pay off debt, more so the bad debt. List down all your debts, outstanding balances, interest rates, and repayment amounts, and classify them as either good (debt invested in cash producing assets) or bad (debt used to buy consumables). Arrange them in terms of priority and start by paying off the bad debts with high-interest rates.

Step 6: Create a plan to invest

Investing in profitable ventures will translate into good returns, thus increasing your income. The easiest way to start building your investment portfolio is through mutual funds as they care easily matched your risk tolerance. Some mutual funds also offer professional money management services that can go a long way in informing your future investment decisions.

Step 7: Review your plan regularly

It is important to note that your financial plan is not static. As you develop good financial habits, become more disciplined, and focus on achieving your goals, you will notice a significant improvement in your net worth. Review your plan regularly, quarterly if you can, and adjust or change your financial goals to reflect your newfound state.

Financial planning is important for everyone, regardless of their income level. It helps you set short- and long-term goals, and figure out how to achieve them. It also gives you a better understanding of your financial situation, so that you can make informed decisions about spending, saving, and investing. A good financial plan can help you reduce stress, sleep better at night, and feel more confident about your future.

In conclusion, while money does not essentially buy you happiness when appropriately managed, it can enhance your quality and increase the satisfaction you get from every dollar spent. Personal financial planning is a crucial step towards your journey to financial freedom, whether you choose to do it yourself using the above 7 simple steps, or whether you decide to seek the services of a professional financial planner. Good luck on your journey to financial freedom!

- What is the Colombo Stock Exchange (CSE)?

- How Do Dimensional Fund Advisors Profit from the Efficient Market Hypothesis?

- Approaches to Designing a Budget

This article is written by:

Nyamonaa Agata

Agata is a Business Advisory and Management Consultant, and Freelance Content Writer passionate about writing and developing content for marketing and educational purposes.