Financial Plans: Budgets

What financial tools can help you make better financial decisions?

To make the right financial decisions for your business, you need tools that provide you with the correct information. “By making informed decisions, you save money and can be more efficient with your business initiatives” (How to Make Critical Financial Decisions for Your Business – Resources | Thinking CapitalTM, n.d.).

These tools include:

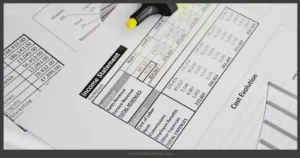

- Financial statements: These are tools that tell you exactly “what is going on, so you can decide on what to change and what to keep as is” (How to Make Critical Financial Decisions for Your Business – Resources | Thinking CapitalTM, n.d.). These provide a snap of your business finances at a given period, giving you a quick overview of your business’s financial health and measuring business performance. Financial statements include income statements, balance sheets, and cash flow statements.

- Financial plan: This tool develops from strategic and business plans to identify the financial resources a business needs. It also details how to obtain and develop those resources to achieve goals. Generally, financial planning generates relevant and realistic budgets as they are used to determine the figures for limitations included in the budget.

- Budget process tools: A budget presents what a business expects to spend (expenses) and earn (revenue) over a specific period. Certainly, budgets are helpful for planning finances and tracking whether the company is operating according to plan. They also help project the amount needed for business initiatives, for example, buying new equipment, hiring new employees, etc.

Other tools include the time value of money, risk assessment, macroeconomic indicators, and microeconomic or personal factors. Indeed, financial tools allow you to identify your economic situation to plan your next steps and the different strategies for achieving them.

What are the components of a comprehensive budget, and what is the purpose of each element?

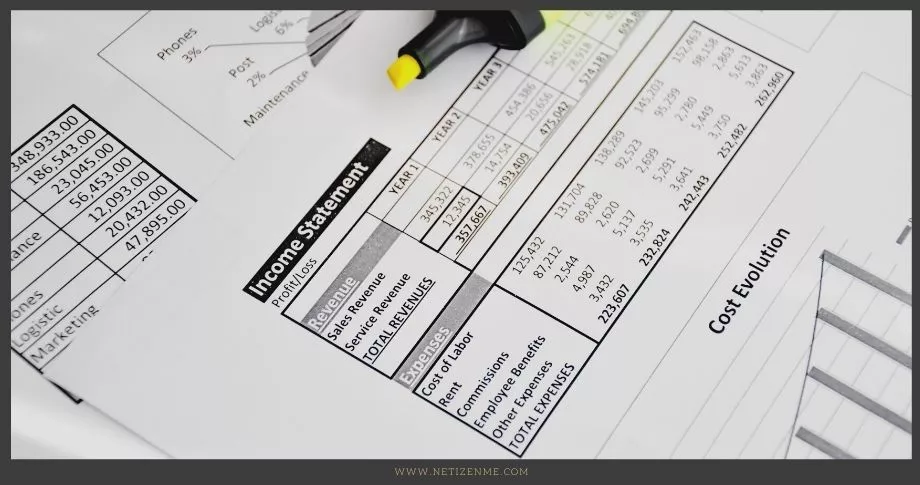

A comprehensive budget, also known as a total budget, is a budget that incorporates all the financial aspects of a business. “It consists of all the recurring income and expenditure and non-recurring expenditure” (Borad, 2020). However, it excludes non-recurring income because, according to conservatism, you should not account for income that is not certain to be earned.

Recurring income consists of earnings from interest, wages/salaries, or dividends. Recurring expenditures include living expenses, loan repayments, electricity bills, administrative other expenses, etc. Examples of a non-recurring expenditure involve repairing or replacing central machinery or its part or purchasing durable items such as a car or refrigerator.

The two main components of a comprehensive budget include:

- Operating budgets: These are short-term budgets for short-term goals involving recurring items. Its purpose is to provide estimates for all recurring items that may be income or expenditure to ensure a balance between income and expenses in the short term. Further, it comprises of sale forecast and sales budget, closing inventory budget, production budget, and direct labour budget. It also includes operating expenses budget, manufacturing overheads budget, and cost of goods manufactured.

- Capital Budgets: These are for long-term goals involving non-recurring items. They are focused on long-term non-recurring financial elements such as investments, capital expenditure on replacements, and additions. This component ensures that businesses take appropriate action to achieve long-term goals as stipulated in the financial plan. And it consists of income statements, cash budgets, capital expenditures, and budgeted balance sheets.

How are specialized budgets prepared? What is the relationship of specialized budgets to the comprehensive budget?

Specialized budgets focus on specific aspects of your finances. They usually reflect a particular activity, such as the cash flow or tax, in more detail, including the effect of owning and maintaining a specific asset or pursuing a certain action.

The relationship is that specialized budgets form parts of the comprehensive budget. Finally, a specialized budget is included in the comprehensive budget, as it is a part of total financial activity.

Check the following reference articles to learn more about the Financial Plans: Budgets:

- Borad, S. B. (2020, October 12). Comprehensive Budget. EFinanceManagement. (URL)

- How to make critical financial decisions for your business – Resources | Thinking CapitalTM. (n.d.). Thinkingcapital.Ca. (URL)

- What is the Colombo Stock Exchange (CSE)?

- How Do Dimensional Fund Advisors Profit from the Efficient Market Hypothesis?

- Approaches to Designing a Budget

This article is written by:

Our professional writers and editors are passionate about sharing high-quality information and insights with our audience. We conduct diligent research, maintain fact-checking protocols, and prioritize accuracy and integrity to the best of our capacity.

You can cite our articles under the author name "Netizenme"