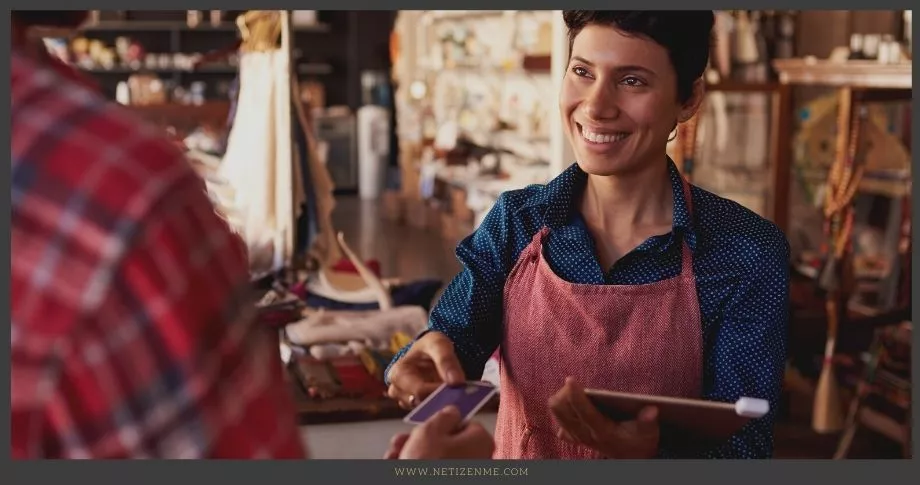

Goods and services can be paid for upfront, on delivery, or supplied on credit. Credit is where payment is deferred for a given period after the supply of goods or services. Before extending a direct line of credit to customers, a business must decide whether this risk is worth taking.

Is giving direct credits to customers a worthy risk for small businesses?

Pros and Cons of Offering Direct Credit

Offering credit to your customers can be a risky but rewarding endeavor.

Pros of offering Direct Credit

- Increased sales by offering credit will attract more prospects and close more deals.

- Enable you to establish trust with customers.

- It increases customer loyalty and goodwill and builds good customer relations.

- It makes customers less sensitive to price and more focused on your products and services.

- Shows stability and enhances the business reputation.

- It gives you a competitive edge as not all businesses offer credit.

Cons of offering Direct Credit

- One of the significant disadvantages of offering credit is the potential for loss when customers fail to pay.

- Its effect on the cash flow.

Tips to Ensure Customers Pay Direct Credit

If you provide credit to customers, it is advisable to set proactive policies and procedures to cut down on the number of delinquent accounts receivable.

Other tips to ensure customers pay you on time include:

- Doing credit checks before extending credit.

- Taking partial payment in advance.

- Invoicing promptly.

- Stating the payment terms and conditions clearly.

- Incentivize the customer behavior you want by offering discounts and other rewards for early payment.

- Establish a follow-up procedure to ensure you quickly follow up on a missed payment.

- Turnover any overdue account to a collection agency.

- Leverage technology by automating the entire process.

Journal Entries for Account Receivables

Account receivables are the money customers owe you for goods and services bought on credit.

- When a sale is made, credit the sales account and debit the accounts receivables account.

- When payment is made, debit the cash account and credit the accounts receivable.

If a customer fails to pay, the business encounters some losses called bad debts. Bad debts are recorded in two ways, i.e., direct write-off and the allowance method. Example of direct write-off journal entries:

Article Sources that you can check out to learn more about Direct Credit to Customers

- Credit, Extending Definition – Entrepreneur Small Business Encyclopedia. (n.d.). Entrepreneur. (URL)

- Jimenez, R. (2019, June 11). What to Do When Customers Don’t Pay: A Guide to Accounts Receivable. PaySimple Blog. (URL)

- Kappel, M. (2016, September 13). Offer Credit to Customers | The Pros & Cons of Extending Credit. Patriot Software. (URL)

- Singh, J. (2020, November 19). Accounts Receivable Journal Entry. WallStreetMojo. (URL)

- Ward, S. (2019, June 25). 7 Ways to Make Sure You’re Getting Paid by Customers and Clients. The Balance Small Business. (URL)

- What is the Colombo Stock Exchange (CSE)?

- How Do Dimensional Fund Advisors Profit from the Efficient Market Hypothesis?

- Approaches to Designing a Budget

This article is written by:

This article is written and edited by in-house writers and editors. Knowledge Netizen editorial team is committed to providing accurate and informative content. You can cite our articles under the author name "NetizenMe"