Choosing the Best Depreciation Method for Machinery

The value of tangible assets decreases over time; this is referred to as depreciation. Depreciation is used in accounting to allocate a tangible asset’s cost over its useful life. It is a tax-deductible expense. It is vital to choose the best depreciation method for machinery to fully realize its benefits.

which depreciation method is best?

What should you consider when choosing a depreciation method?

Factors to consider when choosing a depreciation method include the asset’s nature, tax consideration, technology changes, price fluctuations, accounting conventions, obsolescence, and management policy. Depending on these, a company decides whether to depreciate the asset in terms of time, usage, or expenses incurred.

Terms of time or usage

To estimate how much value an asset has lost, we use time as an estimate. (3). The time-based depreciation methods are straight-line, declining-balance, and sum-of-the-years digits.

The unit-of-production method depreciates assets based on usage. Therefore, it considers the amount of activity the asset experiences and bases depreciation on its actual physical usage. This method is ideal if machinery produces different units each year or may wear out early.

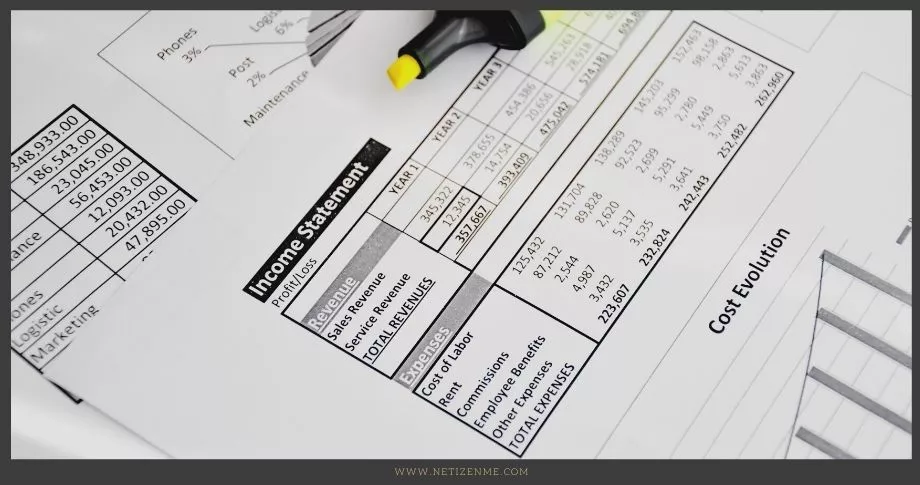

Expenses

Companies can also choose to depreciate machinery depending on the expense amount. How much is required for repairs, whether or not the asset is costly or cheap? In general, the aim is to match the income generated against the expense.

For example, a piece of machinery is expected to generate income evenly over an extended period of time. In that case, you may want to expense equal depreciation amounts through the asset’s life using the straight-line method.

However, if the said machinery has high obsolescence due to rapid technological change, you may need to use the double-declining balance method. In fact, this method will allow you to match the expenses throughout the asset’s useful life. In the early years, higher depreciation is charged when repairs and maintenance costs are low and lower in the later years when repairs and maintenance costs are higher (1).

Double Declining Balance Depreciation Method

This method usually results in a larger amount of expense in the earlier years of the asset’s useful life as opposed to later years (2). Hence, it reflects the fact that an asset is more productive and loses more value in its early years. It allows the company to defer income tax to later years.

The depreciating factor is 2 times that of the straight-line method. Use this formula to calculate:

Depreciation = 2* straight-line depreciation percentage * book value at the beginning of the accounting period

Book value = cost of the asset – accumulated depreciation

or

Periodic depreciation expense = beginning book value* rate of depreciation.

Knowing the beginning book value, useful life, and salvage value are the key assumptions when using this method.

Pros are, it reduces tax obligation, matched maintenance costs, minimum loss at disposal. Conversely, it depicts poor performance in the early years, low dividends, and is more complicated than other methods (1).

Check the following reference articles to learn more about the best depreciation method for machinery:

- Borad, S. B. (2019, June 20). Double Declining Depreciation. EFinanceManagement.com URL

- Corporate Finance Institute. (2020, May 25). Depreciation Methods. URL

- Depreciation methods – What are depreciation methods? (n.d.). Debitoor. URL

- What is the Colombo Stock Exchange (CSE)?

- How Do Dimensional Fund Advisors Profit from the Efficient Market Hypothesis?

- Approaches to Designing a Budget

This article is written by:

Our professional writers and editors are passionate about sharing high-quality information and insights with our audience. We conduct diligent research, maintain fact-checking protocols, and prioritize accuracy and integrity to the best of our capacity.

You can cite our articles under the author name "Netizenme"